FoodShare (Food Stamps) in Wisconsin

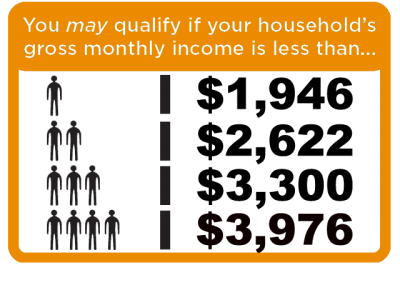

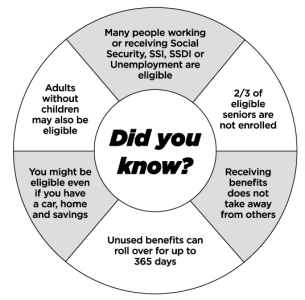

Food Stamps are called FoodShare in Wisconsin. The Wisconsin Department Of Health Services (DHS) administers the program. FoodShare provides financial support for low-income families and individuals to buy nutritious foods. The amount of FoodShare benefits you receive is based on the number of people in your household and your total net monthly income. The DHS defines a household as people who live together and buy food and prepare meals together. To be eligible for FoodShare you must be a U.S. Citizen or in the United State legally.

Food Stamps are called FoodShare in Wisconsin. The Wisconsin Department Of Health Services (DHS) administers the program. FoodShare provides financial support for low-income families and individuals to buy nutritious foods. The amount of FoodShare benefits you receive is based on the number of people in your household and your total net monthly income. The DHS defines a household as people who live together and buy food and prepare meals together. To be eligible for FoodShare you must be a U.S. Citizen or in the United State legally.

To apply for FoodShare online visit getaquestcard.org. To do it over the phone call 1-877-366-3635. You can download and review the FoodShare application here.

If you are eligible for the program your benefits will start within 30 days of applying. If you are not eligible you will get notice stating so within 30 days. There is an appeals process if you believe you were unfairly denied.

In certain urgent circumstances benefits are started within seven days of applying. You are eligible for expedited benefits if your household has $100 or less available in cash or in the bank and

- Expects to receive less than $150 of income this month; or

- Has rent/mortgage or utility costs that are more than your total gross monthly income, available cash or bank accounts for this month; or

- Includes a migrant or season farm worker whose income has stopped

After you are accepted into the program you will receive a Wisconsin QUEST card. Your benefits will be credited to the card every month. The card works like a check card. Your social security number determines the day of the month your benefits are credited to the card.

FoodShare Wisconsin – A Recipe For Good Health

You can use your card at farmers markets and at grocery stores that have the Quest sign. Benefits can be used to by foods such as:

– Breads and cereals

– Fruits and vegetables

– Meats, fish and poultry

– Dairy products

– Seeds and plants to grow food for your family to eat.

You cannot use your benefits to buy the following.

– Nonfood items

– Beer, wine, liquor, cigarettes or tobacco

– Food that will be eaten in the store

– Hot foods (example; food that is purchased and cooked at the store)

FoodShare Statistics

14.4% of the 5.7 million people in Wisconsin receive FoodShare.

55% of the recipients are female and 45% are male.

57% are adults and 43% are minors.

Tags: Bankruptcy, Credit, Financial Freedom