Determining your household size is very important when considering bankruptcy. Your household size is used to look up your state’s median income. If you are below the median income you automatically qualify for a Chapter 7 bankruptcy and do not have to take the means test. If you are above the median income and do … Read more

Read more

A Chapter 13 Bankruptcy may be resolved and your debt discharged within 3 to 5 years. The basic timeline for Chapter 13 Bankruptcy in Wisconsin is listed below. Before Filing: 180 days before filing: You must complete a credit counseling course within 180 days of filing for bankruptcy. 90 days before filing: You must be … Read more

Read more

A Chapter 7 Bankruptcy may be resolved and your debt discharged within as little as 3 months. The basic timeline for Chapter 7 Bankruptcy in Wisconsin is listed below. Before Filing: 180 days before filing: You must complete a credit counseling course within 180 days of filing for bankruptcy. 90 days before filing: You must … Read more

Read more

The big 2005 change in the bankruptcy laws included counseling requirements. People filing for bankruptcy now must complete credit counseling from a government approved organization within 180 days before filing. They must also complete a debtor education course before their bankruptcy discharge will be granted. Both courses can be taken in person, on the phone … Read more

Read more

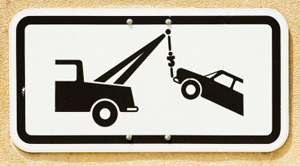

1. Stop or Delay Foreclosure 2. Stop or Delay Repossession 3. Medical Bills 4. Harassment by Debt Collectors 5. Stop Utility Shut Off 6. Stop Garnishment 7. Stop a Law Suit 8. Job Loss 9. Small Business Failure 10. Divorce Call or email Madison Bankruptcy Attorney Zeshan Usman for a free consultation.

Read more

Paying for an attorney to assist you with your bankruptcy may seem impossible given the financial strain you are facing. Many people give up and just assume that if they can’t pay their bills they can not afford to file bankruptcy. Fortunately that is not the case. I have met with hundreds of people who … Read more

Read more

1. Refinance You Car Loan – You may be able to refinance your vehicle and get a lower monthly payment. 2. Ask For A Car Loan Modification – For example, if you have a car loan with 24 months remaining to pay, ask your lender if you can extend the term to 30 or more … Read more

Read more

A series of short videos produced by the Office of the US Trustee on how the bankruptcy process works.

Read more

Payment History Outstanding Credit balances Credit History Type of Credit Inquiries Call or email Madison Bankruptcy Attorney Zeshan Usman for a free consultation.

Read more

ALL income. Examples Rental Income Business Income Investment Income Child Support, Alimony, and Maintenance Gambling Winnings Pensions and Retirement Income Individual Retirement Account (IRA) Withdrawals Life Insurance Policy Withdrawals Money received through Inheritance Social Security / SSDI Benefits Disability Payments Unemployment Insurance Proceeds Workman’s Compensation Food Stamps or Welfare Annuity payments Regular Contributions from others … Read more

Read more